The Philippines’ small and medium scale enterprises (SMEs) can now receive expanded support as they recover from the effects of the COVID-19 pandemic with the new partnership between the Bank of the Philippine Islands (BPI) and the Department of Trade and Industry (DTI).

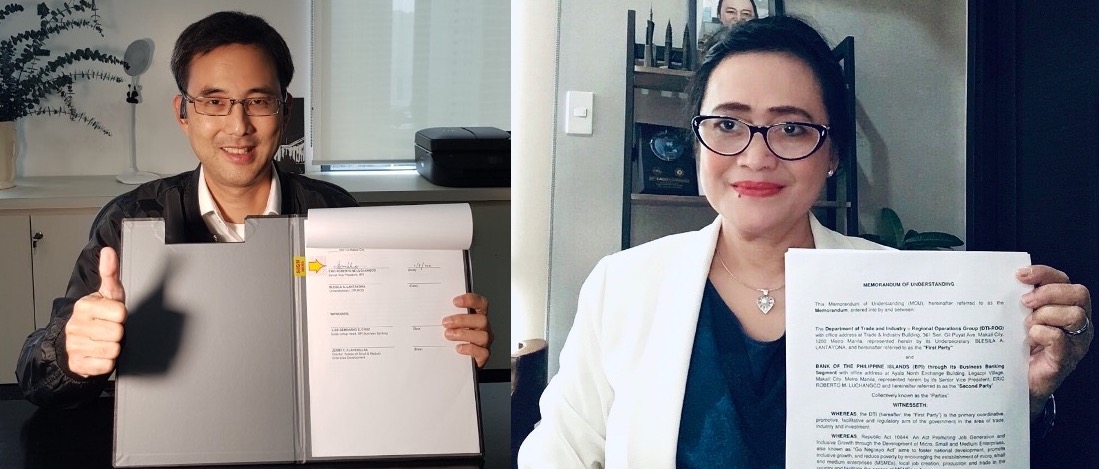

BPI’s Memorandum of Understanding with the DTI will have BPI Business Banking support DTI programs such as SME Roving Academy, Kapatid Mentor Me, Youth Entrepreneurship Program, and regional trade fairs.

BPI will also provide free trainings to SMEs on ways to secure a business, manage and leverage on loans, and bank in the new normal.

Eric Luchangco, BPI Business Banking head, said the Bank recognizes its role in supporting companies and helping the economy grow as it aims to build a more financially inclusive Philippines.

“We hope that through this partnership with DTI, we will be able to make it clear to our SME customers that they are not too small to be served by a large bank. We believe they deserve to have access to the same kind of financial products and services that larger companies already have access to,” said Mr. Luchangco.

DTI-Regional Operations Group Undersecretary Blesila Lantayona expressed the Department’s strong commitment to help the micro, small, and medium enterprises (MSMEs) to recover from adversities brought about by the pandemic and to thrive in the new normal business environment.

“As both parties commit to work together in teaching MSMEs nationwide to adapt and possibly pivot their businesses to the new normal, we look forward to the actualization of this MOU by looking at the greater visibility of BPI, especially in the programs and projects of DTI regional and provincial offices,” said Usec. Lantayona

According to DTI’s partial impact assessment survey on the MSME sector, which was released on February 8, 52 percent of enterprises have gone back to full operation, 42.8 percent have partially opened, while 4.9 percent are still closed—which is a significant improvement from the 30 to 35 percent recorded closed in April 2020.

Furthermore, through the partnership, BPI and DTI will facilitate workshops and programs for SMEs and provide access to working capital loans and other financial products to help them with business continuity.

Filipino MSMEs will also be serviced by the country’s 1st multi-industry product innovation hub.

Filipino SMEs are set to be showcased at the 10th Philippine SME Business Expo virtual edition this February 2021.

SEND CHEERS in the comments below to Philippine SMEs as they receive expanded support with the new BPI and DTI partnership.

Are you a Proud Filipino? Get more good news stories on Filipino Pride! Subscribe to GoodNewsPilipinas.com and our YouTube channel: Good News Pilipinas! TV

The post Philippine SMEs receive expanded support with BPI, DTI partnership appeared first on Good News Pilipinas.

Source: Good News Pilipinas

0 Comments